Fraud has been an enduring scourge throughout human history, perpetuated by individuals and organizations attempting to deceive and manipulate for personal gain. From Ponzi schemes to corporate scams, the history of fraud is replete with stories of deception and betrayal that have resonated across economies and societies. Let’s look at the top 10 frauds of all time, examining the intricate details and staggering data behind each infamous scheme.

1. Ponzi Scheme: Charles the scamster

One of the most notorious frauds of all time, the Ponzi scheme is named after Charles Ponzi, who masterminded a fraudulent investment scheme in the early 20th century. The Ponzi scheme, which promised investors high returns by leveraging new investments to pay off existing investors, collapsed spectacularly, leaving countless investors penniless. The scheme’s lasting legacy serves as a cautionary tale against the allure of get-rich-quick schemes.

Data: Ponzi schemes have defrauded investors of billions of dollars over the years, notable examples include Bernie Madoff’s $65 billion scheme and Stanford Financial Group’s $7 billion fraud.

2. Enron Scandal: The Fall of an Energy Giant

The Enron scandal rocked the corporate world in the early 2000s, exposing widespread accounting fraud and corporate misconduct at the energy giant. Through complex financial tricks and deceptive accounting practices, Enron executives inflated profits and concealed massive losses, bankrupting the company and causing billions in losses for investors and employees alike.

Data: Enron’s bankruptcy resulted in a $74 billion loss in shareholder value and the dissolution of Arthur Andersen, one of the world’s largest accounting firms.

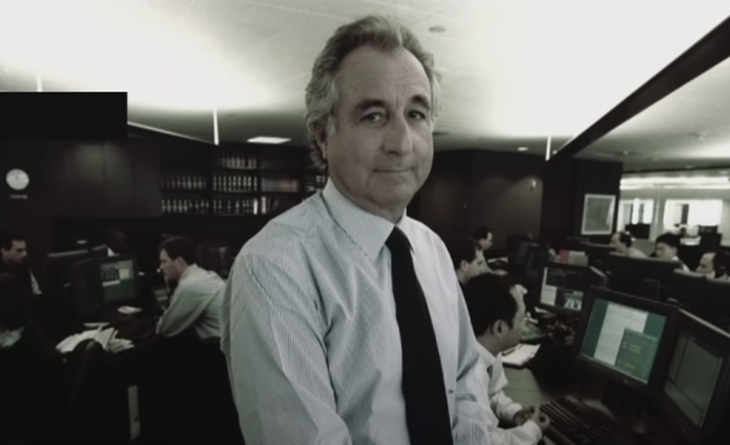

3. Madoff Investment Scam: The Wizard of Lies

Bernie Madoff’s investment scam is one of the largest and most audacious scams in history, defrauding investors of billions over several decades. Operating as a classic Ponzi scheme, Madoff promised investors consistent, high returns while using new investments to pay off existing investments. The scheme collapsed in 2008 amid the global financial crisis, revealing the extent of Madoff’s fraud.

Data: The Madoff investment scandal resulted in investors losing an estimated $65 billion, making it one of the largest financial frauds in history.

4. WorldCom Accounting Fraud: The Fall of the Telecom Giant

WorldCom, once a telecommunications powerhouse, became synonymous with corporate fraud after revelations of accounting irregularities in 2002. Company executives engaged in fraudulent accounting practices to inflate revenues and conceal expenses, which led to the understatement of $3.8 billion in earnings and ultimately bankrupted the company. ,

Data: WorldCom’s bankruptcy was one of the largest in U.S. history, causing a $180 billion loss in shareholder value and resulting in the loss of thousands of jobs.

5. Volkswagen Emissions Scandal: The Dieselgate Hoax

Volkswagen’s emissions scandal shocked the automotive industry, tarnishing the German automaker’s reputation and exposing widespread emissions fraud. Volkswagen engineers installed software in millions of diesel vehicles to cheat emissions tests, allowing the company to circumvent environmental rules and deceive regulators and consumers alike.

Data: Volkswagen agreed to pay more than $33 billion in fines, settlements and recalls related to the emissions scandal, making it one of the costliest corporate scandals in history.

6. Olympus Accounting Scandal: The Dark Side of Corporate Japan

Olympus Corporation, a leading Japanese manufacturer of optical products, found itself embroiled in scandal in 2011 when it was revealed that the company had been hiding investment losses for decades. Olympus executives engaged in a complex scheme involving fraudulent mergers and acquisitions to hide losses, causing a seismic shock in Japan’s corporate governance landscape.

Data: The Olympus accounting scandal resulted in a $1.7 billion loss and the arrest and conviction of several top executives.

7. Theranos Fraud: The Rise and Fall of Silicon Valley’s Darling

Theranos, once known as a revolutionary health care technology company, was spectacularly exposed when its founder Elizabeth Holmes was accused of defrauding investors and patients. Holmes and former Theranos chairman Ramesh “Sunny” Balwani allegedly misled investors, regulators, and the public about the efficacy of the company’s blood-testing technology, resulting in a massive collapse for the once-promising startup.

Data: Theranos’ valuation reached $9 billion at its peak, but the company’s demise cost investors millions of dollars and ruined its once-glorious reputation.

8. Parmalat scandal: The meltdown of the Italian dairy giant

Italy’s largest dairy company, Parmalat, collapsed in 2003 in one of Europe’s largest corporate bankruptcies. The company’s founder, Calisto Tanzi, was accused of hiding billions in debt and committing massive accounting fraud to inflate profits. The Parmalat scandal exposed systemic weaknesses in Italy’s regulatory and banking systems, leading to calls for reform.

Data: Parmalat’s bankruptcy resulted in a €14 billion loss in shareholder value and resulted in criminal convictions for Tanzi and other executives.

9. Wirecard Scandal: The Rise and Fall of Germany’s Fintech Darling

Wirecard, once touted as a fintech success story, imploded in 2020 amid revelations of accounting irregularities and fraudulent activities. The German payments processing company inflated revenues and fudged financial statements to create the illusion of rapid growth, defrauding investors and regulators in the process.

Data: Creditors and investors lost €3.2 billion due to Wirecard’s bankruptcy, making it one of the largest corporate collapses in German history.

10. Colonial Pipeline Ransomware Attack: Cybercrime hits critical infrastructure

The Colonial Pipeline ransomware attack in May 2021 disrupted fuel supplies on the US East Coast and exposed the vulnerability of critical infrastructure to cyber threats. DarkSide, a Russian cybercriminal group, targeted Colonial Pipeline’s computer systems, encrypting data and demanding ransom payment to restore access, underscoring the growing threat cybercrime poses to global security.

Data: Colonial Pipeline paid a $4.4 million ransom to hackers to regain control of its systems, highlighting the enormous financial and operational costs of cyberattacks on critical infrastructure.

Conclusion: Learning from the past to prevent future fraud

As we consider the top 10 frauds of all time, it becomes clear that fraud knows no borders, it spans industries, borders, and ideologies. From corporate titans to tech startups, no organization is immune to the allure of deception and the lure of ill-gotten gains. However, by studying these historical frauds and implementing strong regulatory frameworks, transparent governance structures, and vigilant oversight mechanisms, we can reduce the risk of future fraud and protect the integrity of our financial systems.

As individuals, investors and policymakers, it is our duty to remain vigilant, question the status quo and hold accountable those who seek to exploit trust for personal gain. Only then can we build a future based on integrity, transparency and ethical conduct, where the lessons of the past will serve as guides to a more resilient and equitable society.